For Mortgage Loan Originators (MLOs) in the Last Frontier, the annual renewal cycle is more than just a regulatory box to check—it’s a commitment to professional excellence. Navigating Alaska mortgage continuing education (CE) requires a clear understanding of NMLS mandates, state-specific nuances, and the logistical hurdles of the renewal window.

Whether you are operating out of Anchorage, Fairbanks, or remotely, staying ahead of the year-end rush is critical. Alaska follows a streamlined approach under the SAFE Act, but the details of “successive year” rules and reporting timelines can still trip up even the most seasoned professionals. This guide provides a comprehensive roadmap for completing your NMLS-approved Alaska mortgage continuing education with ease.

1. The Core Requirements: The 8-Hour Rule

Alaska’s Division of Banking and Securities maintains a straightforward requirement for MLOs. Unlike states like Washington or Oregon, which require local law electives, Alaska currently relies on the standard 8-hour SAFE Comprehensive course structure.

The Standard Hour Breakdown:

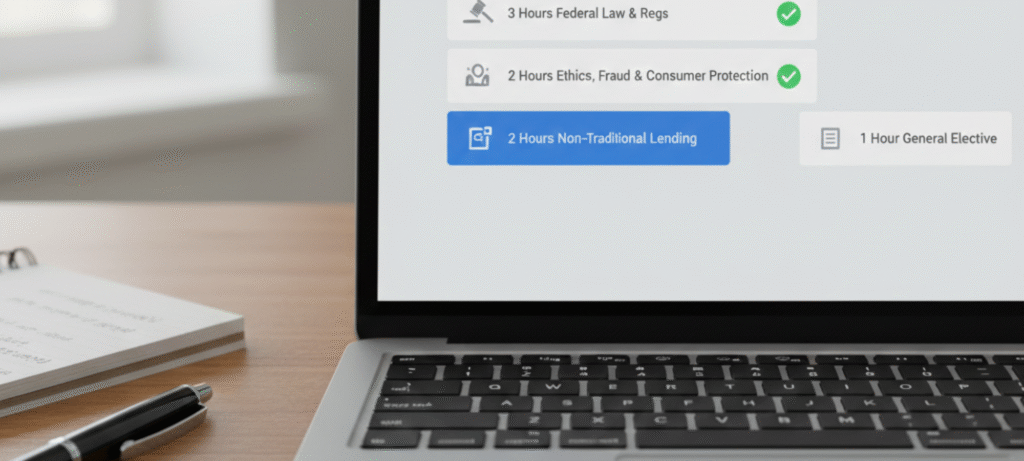

To maintain an active license, you must complete a minimum of 8 hours of NMLS-approved education annually. The curriculum is strictly divided to cover the most critical pillars of the industry:

- 3 Hours of Federal Law and Regulations: This section covers the latest updates to the Truth in Lending Act (TILA), the Real Estate Settlement Procedures Act (RESPA), and other federal mandates that evolved throughout 2025 and 2026.

- 2 Hours of Ethics: A deep dive into fraud prevention, fair lending practices, and consumer protection. Ethics isn’t just about “doing the right thing”—it’s about understanding the legal ramifications of fair housing and anti-money laundering (AML) laws.

- 2 Hours of Non-Traditional Mortgage Lending: As the market shifts, this segment focuses on loan products beyond the standard 30-year fixed-rate mortgage, including adjustable-rate mortgages (ARMs), reverse mortgages, and interest-only options.

- 1 Hour of General Elective: This final hour provides a broader look at mortgage origination practices, allowing you to round out your knowledge.

2. Navigating the “Successive Year” Rule

One of the most common reasons an MLO’s renewal is rejected isn’t because they didn’t take a class—it’s because they took the wrong one. The NMLS “Successive Year” rule is a federal mandate designed to ensure professionals receive fresh information every year.

The Rule: An MLO may not take the same NMLS-approved course two years in a row.

If you used “Course A” from a provider in 2025, you must ensure that your 2026 course has a different NMLS ID number. Most top-tier providers like The CE Shop, OnCourse Learning, and Mortgage Educators automatically update their “2026 SAFE Comprehensive” packages with new content and new IDs to prevent this conflict. However, if you switch providers or pick “Late CE” courses, you must double-check the Course ID in your NMLS record.

3. The 2026 Renewal Timeline: Don’t Wait for the Snow

While the official NMLS renewal period is November 1 through December 31, waiting until the final weeks of December is a high-stakes gamble. Alaska MLOs are prevented from even applying for renewal until their CE hours are fully reported and “banked” in the NMLS system.

The “Smart Renewal” Deadlines:

To avoid the stress of a lapsed license, follow the NMLS-recommended timeline:

- The SMART Deadline (December 10): Aim to finish your CE by this date. This allows plenty of time for the provider to report your hours (which can take up to 7 days) and for you to submit your renewal application.

- The At-Risk Deadline (December 17): If you finish after this date, there is a significant risk that your hours won’t be banked in time for the NMLS to process your renewal before January 1.

- The Reinstatement Period (January 1 – February 28): If you miss the December 31 deadline, your license will lapse. You will be unable to originate loans and must complete “Late CE” courses and pay additional reinstatement fees.

Just as a student benefits from the structured depth of The Benefits of Classical Education, an MLO benefits from a structured approach to their annual training. Proactive planning is the only way to ensure your business continues without interruption.

4. Competitive Analysis: Choosing Your CE Provider

Selecting a provider for your Alaska mortgage continuing education involves balancing price, course format, and reporting speed. Based on 2026 market data, here is how the top players stack up for Alaskan professionals.

| Provider | Format Options | Reporting Speed | 2026 Pricing (Approx.) | Best For |

| The CE Shop | Online Self-Paced | Within 7 days | $85 – $110 | Mobile-friendly users & those needing high flexibility. |

| Mortgage Educators | Video-Based | 1-2 Business Days | $75 – $95 | Budget-conscious MLOs who prefer video content. |

| OnCourse Learning | Live Webinar / Online | Next Day | $90 – $120 | MLOs who want a live, interactive experience. |

| Champions School | Virtual Classroom | Within 48 Hours | $100 – $135 | Those who prefer a “traditional school” feel via Zoom. |

The “Seat Time” Factor

Remember that all NMLS-approved courses are “clock-hour” based. This means you cannot simply click through the slides. The system tracks your active time to ensure you spend the full 8 hours engaged with the material

5. Added Value: Beyond the 8 Hours

While the 8-hour course is the minimum for the MLO license, many Alaska professionals find that extra education provides a competitive edge in a tightening market.

- Alaska Housing Finance Corporation (AHFC) Classes: For those working with state-backed programs, the AHFC offers specialized classes on Alaska-specific financing options and energy-efficiency interest rate reductions. These often count for Real Estate CE but provide invaluable knowledge for mortgage pros.

- Ethics and Fraud Protection: In 2026, wire fraud and identity theft are at an all-time high. A deeper understanding of these risks doesn’t just keep you compliant—it protects your reputation and your clients’ assets.

Maintaining your professional edge is a holistic process. Much like Grading Sprains requires an understanding of different severity levels to provide the right care, an MLO must understand the nuances of various loan products and compliance risks to serve their clients effectively.

People Also Ask

Do I need Alaska-specific law hours for my MLO renewal?

No. Currently, Alaska does not require a state-specific law elective. You only need the 8-hour SAFE Comprehensive course.

I just got my license in 2026. Do I need to take CE this year?

If you completed your 20 hours of Pre-Licensure Education (PE) in 2026, you are generally exempt from taking CE for the 2026 renewal cycle. You will begin your CE requirements in 2027.

What is the “Late CE” requirement?

If you fail to complete your 8 hours by December 31, you must take a course specifically designated as “Late CE” by the NMLS to reinstate your license.

Frequently Asked Questions

Can I take my Alaska CE on a mobile phone?

Most modern providers like The CE Shop and OnCourse Learning have mobile-optimized platforms, but ensure you have a stable internet connection so your “seat time” is recorded accurately.

How long does it take for my credits to show up in NMLS?

By law, providers have up to 7 calendar days to report your hours. However, many top providers report within 24 to 48 hours. You should always check your “Education Record” in your NMLS consumer portal to verify.

Are there any other costs besides the course tuition?

Yes. The NMLS charges a $1.50 per credit hour “banking fee” to record your hours. Most providers collect this fee ($12 total for 8 hours) at the time of purchase and pass it on to the NMLS for you.

What if I am licensed in multiple states?

If you hold licenses in other states (like Washington or California), you may need additional state-specific electives. You should look for “Multi-State CE Packages” to save money and ensure all requirements are met simultaneously.

Final Thought: Excellence in the Last Frontier

Completing your Alaska mortgage continuing education shouldn’t feel like a burden. It is an annual opportunity to reset your standards and stay current in an industry that never stops moving. By choosing the right provider, respecting the “successive year” rule, and beating the December deadlines, you ensure that your career remains as resilient as the Alaskan landscape.

Education is the foundation of trust. Whether it’s mastering The Benefits of Classical Education for personal growth or staying compliant with Grading Sprains in a clinical sense, expertise is what sets you apart. In the mortgage world, your 8 hours of CE are the key to unlocking another year of helping Alaskans achieve the dream of homeownership.